A New Tax Law

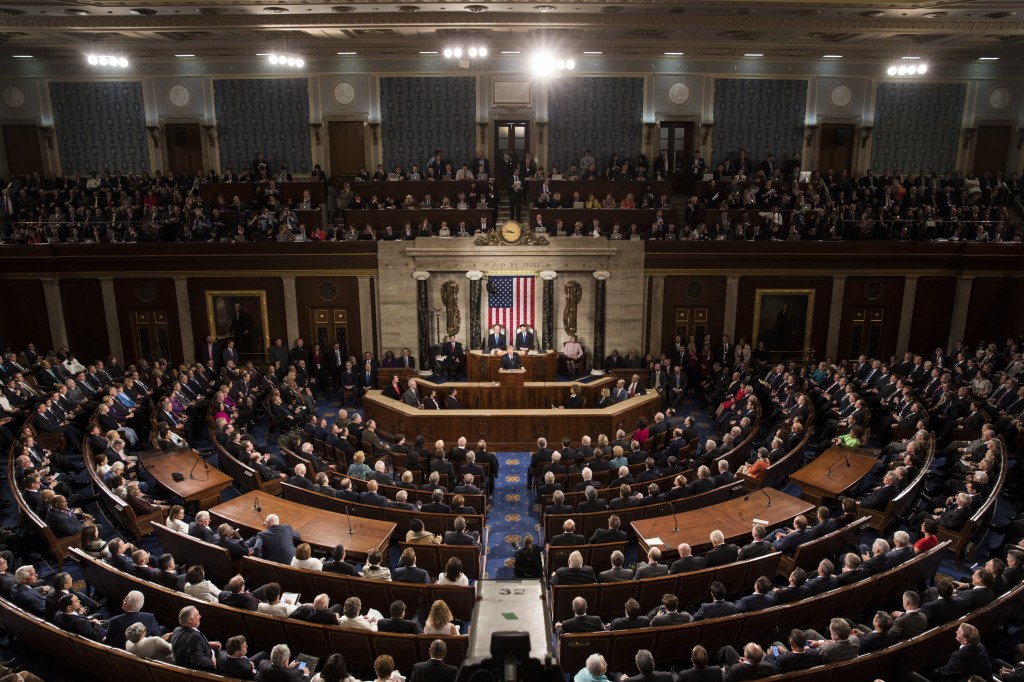

On December 22, President Donald Trump signed a new $1.5 trillion tax bill into law. The law went into effect on January 1. It is the biggest change to U.S. tax law since 1986. At a signing ceremony in the Oval Office, Trump called the bill “something I’m very proud of.”

The tax plan is Trump’s first major legislative

legislation

SAMUEL CORUM/ ANADOLU AGENCY/GETTY IMAGES

a set of laws created by the government

(noun)

Congress just passed new tax legislation.

achievement since taking office in January 2017. On December 20, the Senate approved the bill in a vote of 51 to 48. The House of Representatives passed the bill 224 to 201. No Democratic members of Congress voted to approve the bill.

SAMUEL CORUM/ ANADOLU AGENCY/GETTY IMAGES

a set of laws created by the government

(noun)

Congress just passed new tax legislation.

achievement since taking office in January 2017. On December 20, the Senate approved the bill in a vote of 51 to 48. The House of Representatives passed the bill 224 to 201. No Democratic members of Congress voted to approve the bill.

“This is change that is going to put our country on the right path,” said Paul Ryan. He is the Speaker of the House.

The new tax plan delivers big tax cuts for corporations

corporation

ADAM BERRY/GETTY IMAGES

a large business

(noun)

Amazon is a large corporation that sells things online.

. Republicans say businesses that pay less in taxes will invest

invest

ADAM BERRY/GETTY IMAGES

a large business

(noun)

Amazon is a large corporation that sells things online.

. Republicans say businesses that pay less in taxes will invest

invest

CHIANCHAI PUNDEJ/EYEEM/ GETTY IMAGES

to spend money, time, or energy in the hopes of getting more back at a later time

(verb)

My uncle invests his money by purchasing stock.

in new equipment and hire more workers. This will make businesses more competitive and improve the nation’s economy.

CHIANCHAI PUNDEJ/EYEEM/ GETTY IMAGES

to spend money, time, or energy in the hopes of getting more back at a later time

(verb)

My uncle invests his money by purchasing stock.

in new equipment and hire more workers. This will make businesses more competitive and improve the nation’s economy.

Critics say the law gives the greatest benefits to the wealthy. It is “simply theft—monumental, brazen

brazen

LUCIDIO STUDIO INC./GETTY IMAGES

bold; defiant

(adjective)

Even though my mom said we couldn't, my brother brazenly took a cookie out of the cookie jar.

theft from the American middle class and from every person who aspires to reach

[the middle class],” said Nancy Pelosi. She is the House minority leader.

LUCIDIO STUDIO INC./GETTY IMAGES

bold; defiant

(adjective)

Even though my mom said we couldn't, my brother brazenly took a cookie out of the cookie jar.

theft from the American middle class and from every person who aspires to reach

[the middle class],” said Nancy Pelosi. She is the House minority leader.

But the president is hopeful about the plan. “A lot of things are going to be happening in the U.S.A.,” he said before signing the bill. “It’s going to be a tremendous thing for the American people.”